Buying a home in Australia can be both exciting and daunting. With its diverse landscapes, from bustling cities to serene coastal towns, Australia offers a wide range of property options. If you’re considering purchasing a home down under, here’s a comprehensive guide to help you navigate the process.

-

Understanding the Market

Before diving into property listings, it’s crucial to understand the Australian real estate market. The market can vary significantly between cities and regions. For instance, Sydney and Melbourne tend to have higher property prices compared to regional areas like Hobart or Toowoomba. Research the market trends in the area you’re interested in to get a sense of property values and growth potential.

-

Financial Preparation

Budgeting: Determine how much you can afford to spend on a property. This involves not only the purchase price but also additional costs such as stamp duty, legal fees, and inspection costs.

Budgeting: Determine how much you can afford to spend on a property. This involves not only the purchase price but also additional costs such as stamp duty, legal fees, and inspection costs.

Mortgage Pre-Approval: Speak with a mortgage broker or lender to get pre-approval for a loan. This will give you a clear idea of your borrowing capacity and strengthen your position when making an offer.

-

Choosing the Right Location

Location is a critical factor in property buying. Consider the following:

Proximity to Amenities: Look for areas close to schools, public transport, shopping centers, and healthcare facilities.

Lifestyle: Think about your lifestyle preferences. Do you prefer urban living with easy access to entertainment and dining, or a quieter suburban or rural setting?

Future Growth: Research the area’s potential for future growth. Look into planned infrastructure developments or new amenities that could increase property values.

-

Finding a Property

Online Search: Use property listing websites to browse available properties. Filter your search based on criteria such as location, price range, and property type.

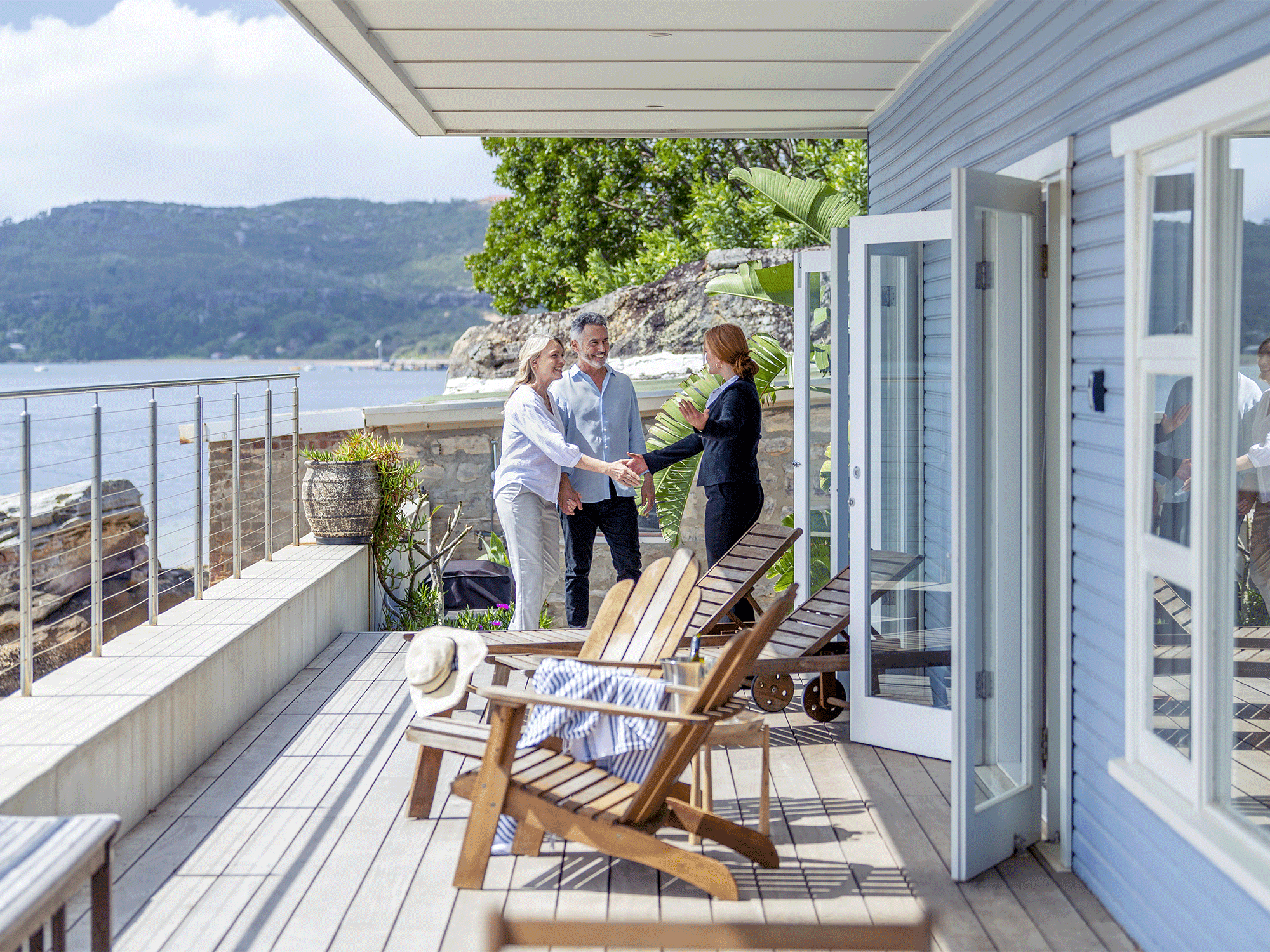

Real Estate Agents: Engage a local real estate agent who knows the area well. They can provide valuable insights and help you find properties that meet your criteria.

Open Inspections: Attend open houses and inspections to get a firsthand look at potential homes. Pay attention to the condition of the property and any potential issues.

-

Making an Offer

Once you’ve found a property you’re interested in, it’s time to make an offer. You can do this through your real estate agent. Be prepared to negotiate with the seller on the price and terms of the sale.

-

Legal and Financial Considerations

Conveyancing: Hire a conveyancer or solicitor to handle the legal aspects of the property transaction. They will review contracts, conduct searches, and ensure that the transfer of ownership is carried out smoothly.

Building and Pest Inspections: Arrange for building and pest inspections to identify any potential issues with the property. These inspections can help you avoid costly surprises later on.

-

Settlement and Moving In

Once the contract is signed and all conditions are met, the settlement process begins. This involves transferring the property ownership and paying the remaining balance of the purchase price. After settlement, you can collect the keys and move into your new home.

-

Ongoing Costs and Maintenance

Owning a home involves ongoing costs such as property taxes, insurance, and maintenance. Budget for these expenses to ensure that you can comfortably manage your property in the long term.

Buying a home in Australia requires careful planning and consideration. By understanding the market, preparing your finances, choosing the right location, and seeking professional advice, you can make the process smoother and more successful. Whether you’re buying your first home or investing in property, thorough research and preparation are key to making informed decisions and achieving your real estate goals.

Buying a home is not just a short-term decision; it impacts your long-term financial health. Financial planners help you:

Buying a home is not just a short-term decision; it impacts your long-term financial health. Financial planners help you:

Research and Due Diligence: Thoroughly research the market, property values, and local regulations. Due diligence helps in making informed decisions and mitigating risks.

Research and Due Diligence: Thoroughly research the market, property values, and local regulations. Due diligence helps in making informed decisions and mitigating risks.

Settlement is the final step in the real estate transaction. This is when the property officially changes hands. Both parties need to ensure that all conditions of the contract are met, and the transaction is executed smoothly. Your conveyancer or solicitor will play a key role in this process, coordinating with the buyer, seller, and financial institutions.

Settlement is the final step in the real estate transaction. This is when the property officially changes hands. Both parties need to ensure that all conditions of the contract are met, and the transaction is executed smoothly. Your conveyancer or solicitor will play a key role in this process, coordinating with the buyer, seller, and financial institutions. Before diving into the real estate market, take a close look at your current financial situation. Assess your income, savings, debts, and expenses. This will give you a clear picture of how much you can afford to invest in property without overextending yourself.

Before diving into the real estate market, take a close look at your current financial situation. Assess your income, savings, debts, and expenses. This will give you a clear picture of how much you can afford to invest in property without overextending yourself.

Ultimately, professionalism in real estate contributes to a positive and seamless experience for clients. From initial consultation to final transaction, a professional approach ensures that every step is handled with care and expertise. This not only helps in achieving desirable outcomes but also in building long-term relationships and fostering client satisfaction.

Ultimately, professionalism in real estate contributes to a positive and seamless experience for clients. From initial consultation to final transaction, a professional approach ensures that every step is handled with care and expertise. This not only helps in achieving desirable outcomes but also in building long-term relationships and fostering client satisfaction. Overview: The buy and hold strategy involves purchasing a property and holding onto it over the long term, allowing its value to appreciate. This strategy is favored by investors seeking capital growth, with the aim of selling the property at a higher price in the future.

Overview: The buy and hold strategy involves purchasing a property and holding onto it over the long term, allowing its value to appreciate. This strategy is favored by investors seeking capital growth, with the aim of selling the property at a higher price in the future.

buyer’s agent provides unbiased advice throughout the buying process. Unlike real estate agents who represent sellers, buyer’s agents are focused solely on the best interests of the buyer. They offer honest assessments of properties and can help clients avoid emotional decisions that may not align with their financial goals.

buyer’s agent provides unbiased advice throughout the buying process. Unlike real estate agents who represent sellers, buyer’s agents are focused solely on the best interests of the buyer. They offer honest assessments of properties and can help clients avoid emotional decisions that may not align with their financial goals.